Home > Registration > 12AA & 80G Registration

Document Required:

PAN Card

COI/Trust Deed

Any Other Registration Certificate

All Promoters Details

Last 3 Years Financial Statement (If Available)

12AA & 80G Registration

End-to-End Assistance* for 80G & 12AA Registration.

Basic

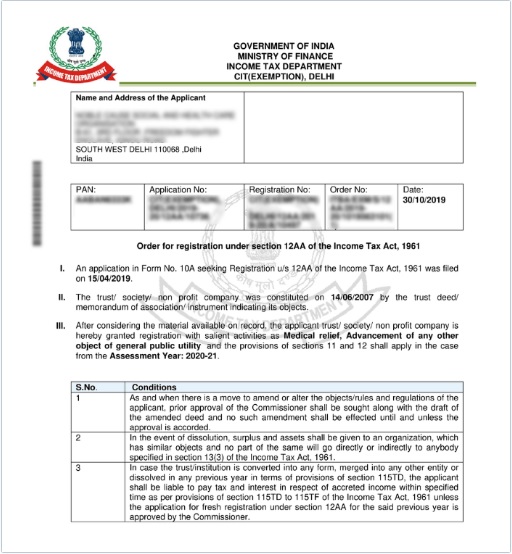

12AA Registration Certificate

12AA Registration Certificate

80G Registration Certificate

80G Registration Certificate

Other Related Services

Trust Registration, Society Registration, Accounting, Invoicing, TDS Return Filing, 80G Donation Return Filing, Income Tax Return (ITR) Filing, Banking and Payroll

Price Summary

Market Price: ₹16,999

Accountingforte:

₹11,799 All Inclusive

You Save: ₹5,200 (30%)

Government Fee: Included

12AA & 80G Registration

12AA and 80G registrations are related to the tax-exempt status of non-profit organizations in India. Here’s some information about each of these registrations:

12AA Registration:

12AA registration is provided under the Income Tax Act, 1961 to grant tax-exempt status to charitable or religious organizations. It allows the organization to claim full exemption from income tax on their surplus income. To obtain 12AA registration, the organization needs to apply to the Commissioner of Income Tax (Exemption) with the required documents and information, including the objectives of the organization and its financial statements. The Commissioner evaluates the application and grants the registration if the organization meets the eligibility criteria.

80G Registration:

80G registration allows donors to claim tax deductions for donations made to eligible charitable organizations. Under Section 80G of the Income Tax Act, donors can claim a deduction of 50% or 100% of the donated amount, depending on the nature of the organization. To obtain 80G registration, the charitable organization must apply to the Commissioner of Income Tax (Exemption) and provide the necessary details, such as the organization’s objectives, financial statements, and audited accounts. The Commissioner reviews the application and grants the registration if the organization meets the required criteria.

To obtain 12AA and 80G registration in India, which are related to tax exemptions for charitable and non-profit organizations, you will need to provide certain documents. While the specific requirements may vary depending on the jurisdiction and authorities involved, here is a general list of documents commonly required for 12AA and 80G registration:

Memorandum of Association (MoA) and Articles of Association (AoA) or Trust Deed: These documents outline the objectives, rules, and regulations of your organization and its governance structure. They should be properly executed and notarized.

Registration Certificate: If your organization is registered under any relevant law, such as the Societies Registration Act, 1860, or the Indian Trusts Act, 1882, you need to provide the registration certificate.

PAN Card: Permanent Account Number (PAN) card issued by the Income Tax Department for the organization.

Address Proof: Documents showing the registered office address of the organization, such as the utility bill (electricity bill, water bill, etc.) or the rental agreement.

Bank Account Details: Provide a copy of the bank statement for the organization’s bank account.

Income and Expenditure Statements: Provide audited or certified financial statements for the past three years, including the income and expenditure statements, balance sheets, and receipts.

Activity Reports: Prepare a detailed report on the activities carried out by your organization since its inception. This report should include the nature of activities, beneficiaries, geographical reach, and impact achieved.

List of Board Members: Provide a list of board members or trustees, including their names, addresses, occupations, and proof of identification (such as PAN cards).

Documents related to Key Officials: Submit the documents related to the key officials, such as the Chief Functionary, Chairman, or President of the organization. This may include their PAN cards, proof of address, and photographs.

Trustee Declarations: Individual trustees or members of the governing body may need to submit declarations affirming their eligibility and non-involvement in any prohibited activities.

Niti Aayog Registration

NITI Aayog (National Institution for Transforming India) is a policy think tank of the Government of India. It does not have a specific registration process for individuals or entities to register with NITI Aayog itself. NITI Aayog’s primary role is to provide policy recommendations and strategic guidance to the Indian government for various sectors of the economy.

However, there are certain programs, schemes, and initiatives undertaken by NITI Aayog where individuals, organizations, or institutions can participate or register. These programs could include initiatives related to entrepreneurship, innovation, sustainable development, social sector schemes, and more.

To participate or register for specific programs or initiatives launched by NITI Aayog, you would need to follow the guidelines and procedures outlined by the respective program or initiative. These guidelines may vary depending on the nature of the program and the target audience.

It is advisable to regularly visit the official NITI Aayog website (niti.gov.in) or contact NITI Aayog directly to stay updated on the latest programs, initiatives, and any specific registration processes associated with them. The website will provide detailed information about ongoing schemes, application procedures, eligibility criteria, and contact details for further inquiries.

To register with NITI Aayog, which is a policy think tank of the Government of India, you may need to provide certain documents. Here is a general list of documents that may be required for NITI Aayog registration:

Memorandum of Association (MoA) and Articles of Association (AoA) or Trust Deed: These documents outline the objectives, rules, and regulations of your organization and its governance structure. They should be properly executed and notarized.

Registration Certificate: If your organization is registered under any relevant law, such as the Societies Registration Act, 1860, the Indian Trusts Act, 1882, or the Companies Act, 2013, you need to provide the registration certificate.

PAN Card: Permanent Account Number (PAN) card issued by the Income Tax Department for the organization.

Address Proof: Documents showing the registered office address of the organization, such as the utility bill (electricity bill, water bill, etc.) or the rental agreement.

Bank Account Details: Provide a copy of the bank statement for the organization’s bank account.

Annual Reports: Provide copies of the organization’s annual reports for the past three years, including the financial statements, audited or certified by a chartered accountant.

List of Office Bearers: Provide a list of office bearers or members of the governing body, including their names, addresses, occupations, and proof of identification (such as PAN cards).

Profile of the Organization: Prepare a detailed profile of your organization, including its mission, objectives, activities, projects, and accomplishments.

Project Proposals: If your organization has ongoing or proposed projects, provide details of those projects, including their objectives, timelines, and budgets.

Certificates or Accreditations: If your organization has obtained any certifications or accreditations related to its work or operations, include copies of those documents.

Other Relevant Documents: Depending on the nature of your organization and its activities, additional documents may be required. These could include documents related to collaborations, partnerships, licenses, or any other relevant information.