Home > Registration > PF & ESI Registration

PF & ESI Registration

PF & ESI Registration for businesses having less than 25 employees.

PF Registration

PF Registration

ESI Registration

ESI Registration

Other Related Services

EPF Retun Filing, ESIC Reurn Filing, GST Registration, Invoicing, GST Filing, TDS Return Filing, Accounting, Income Tax Return (ITR) Filing, Banking and Payroll

GST Invoice

Get GST eInvoice with Input Tax Credit

Price Summary

Market Price: ₹29,999

Accountingforte: ₹11,999 All Inclusive

You Save: ₹18,000 (60%)

Government Fee: Included

Accountingforte: ₹11,999 All Inclusive

You Save: ₹18,000 (60%)

Government Fee: Included

EPF & ESIC Registration

PF (Provident Fund) and ESI (Employee’s State Insurance) registrations are mandatory registrations in India that are designed to provide social security and financial benefits to employees.

PF (Provident Fund) Registration:

Provident Fund is a social security scheme that aims to provide financial stability and retirement benefits to employees.

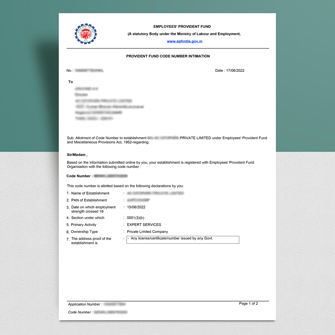

PF registration is required under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952.

It is mandatory for establishments with 20 or more employees, and establishments with fewer employees can voluntarily register for PF.

The employer and employee both contribute a percentage of the employee’s salary to the provident fund account.

The accumulated amount in the provident fund account can be withdrawn by the employee upon retirement, resignation, or other eligible circumstances.

PF registration helps employees secure their future by building a retirement corpus and accessing financial assistance during emergencies.

Why are PF and ESI Registrations Needed?

Legal Compliance: PF and ESI registrations are legal requirements mandated by the Indian government. Employers are obligated to register and comply with these schemes to ensure the welfare and protection of their employees.

Employee Benefits: PF and ESI registrations provide important benefits to employees, including retirement savings through the provident fund and access to medical facilities, healthcare services, and financial assistance during sickness, maternity, and other eligible events.

Social Security: PF and ESI registrations contribute to the overall social security framework in India by promoting employee welfare, financial stability, and healthcare access.