Home > Startup > Nidhi Company

Document Required:

Director KYC-

PAN Card

Aadhar Card

Voter ID Card/Passport/Driving License

Latest 6 Months Bank Statements

Passport Size Photograph

Rent Agreement & Electricity Bill

Nidhi Company

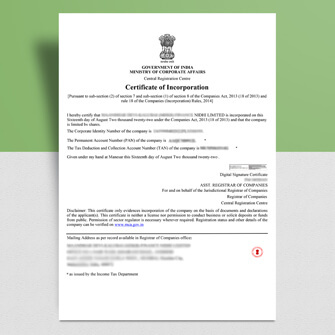

Nidhi Company registration including Incorporation kit and share certificates.

Basic

Company Registration

Company Registration

Share Certificates

Share Certificates

PAN Card

PAN Card

TAN

TAN

ESIC & EPF

ESIC & EPF

8 Digital Signature (DSC)

8 Digital Signature (DSC)

1 Run Name Approval

1 Run Name Approval

Current Account Opening

Current Account Opening

Other Related Services

GST Registration, Accounting, Invoicing, GST Filing, TDS Return Filing, Income Tax Return (ITR) Filing, ROC Filing, Banking and Payroll

Free Current Bank Account

Zero Account Maintenance Charges for 1 Year

GST Invoice

Get GST eInvoice with Input Tax Credit

Price Summary

Market Price: ₹38,999

Accountingforte: ₹25,960 All Inclusive

You Save: ₹13,039 (33%)

Government Fee: Included

Accountingforte: ₹25,960 All Inclusive

You Save: ₹13,039 (33%)

Government Fee: Included

Nidhi Company

Nidhi Companies in India are created for cultivating the habit of thrift and savings amongst its members. Nidhi companies are allowed to borrow from their members and lend to their members. Therefore, the funds contributed to a Nidhi company are only from its members (shareholders). Nidhi companies are minute when compared to the banking sector and are mainly used to cultivate a saving amongst a group of people.

A Nidhi Company is a type of non-banking financial institution (NBFI) in India that operates as a mutual benefit society. It is regulated by the Ministry of Corporate Affairs (MCA) under the Nidhi Rules, 2014. Nidhi Companies are primarily formed to cultivate the habit of thrift and savings among their members and provide them with financial assistance.

Here are some key features of a Nidhi Company:

Membership: Nidhi Companies are member-based organizations. They can only have individuals as members and cannot accept deposits or provide services to non-members. The membership is open to individuals who share the common goal of promoting savings and financial cooperation.

Mutual Benefit: The primary objective of a Nidhi Company is to promote the welfare of its members by cultivating a habit of savings and providing financial assistance among them. The funds collected from members are utilized for the mutual benefit of the members themselves.

Limited Liability: A Nidhi Company is formed as a public limited company, but with limited liability for its members. The liability of the members is limited to the unpaid amount on their shares and does not extend to their personal assets.

Core Activities: Nidhi Companies primarily engage in the acceptance of deposits and the lending of funds to their members. They facilitate savings schemes, recurring deposit schemes, fixed deposit schemes, and other similar activities to promote financial cooperation among members.

Minimum and Maximum Members: A Nidhi Company must have a minimum of 200 members within one year of incorporation. It cannot have more than 15% of its members from the same family. This requirement ensures the broad-based participation of individuals.

Capital Requirements: Nidhi Companies have specific capital requirements. They must have a minimum paid-up equity share capital of INR 5 lakhs and meet other financial criteria prescribed by the Nidhi Rules, 2014.

Regulatory Compliance: Nidhi Companies are subject to regulatory oversight by the Ministry of Corporate Affairs (MCA). They must comply with the provisions of the Companies Act, 2013, and the Nidhi Rules, 2014. Compliance includes filing annual financial statements, conducting regular meetings, maintaining proper accounting records, and adhering to other corporate governance requirements.