Home > Registration > Import Export Code Registration

Document Required:

PAN Card

Aadhaar Card

Certificate of Incorporation

Rent Agreement & Electricity Bill

Import Export Code Registration

Start an Import or Export Business from India.

Startup New Registration

✅ DGFT IE Code

✅ Export Invoicing Software

✅ DBS Exporter Account

Upgrade Registration

✅ DDBS Exporter Account

✅ DGFT Digital Signature

✅ ICE Gate

✅ GST LUT

✅ RCMC Registration

Other Related Services

GST Registration, Invoicing, GST Filing, TDS Return Filing, Accounting, Income Tax Return (ITR) Filing, Banking and Payroll

Free Current Bank Account

Zero Account Maintenance Charges for 1 Year

GST Invoice

Get GST eInvoice with Input Tax Credit

Price Summary

Market Price: ₹5,999

Accountingforte: ₹2,999 All Inclusive

You Save: ₹3,000 (50%)

Government Fee: Included

Accountingforte: ₹2,999 All Inclusive

You Save: ₹3,000 (50%)

Government Fee: Included

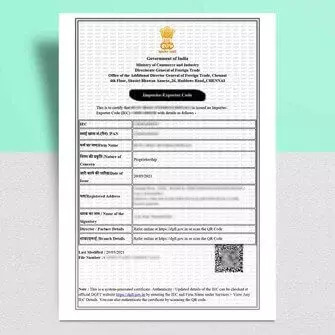

Import Export Code Registration

The Import Export Code (IEC) is a 10-digit alphanumeric code issued by the Directorate General of Foreign Trade (DGFT) in India. It is a unique identification number assigned to individuals or businesses that are involved in importing or exporting goods and services to or from India.

The IEC is required for any individual or entity that wishes to engage in import or export activities. It is mandatory for importers to obtain the IEC from the DGFT before they can import goods into India. Similarly, exporters need to have the IEC in order to export goods from India.

Here are some key points about the Import Export Code:

Application Process: To obtain an IEC, an application must be submitted to the DGFT or its authorized offices. The application can be filed online, and the necessary documents and fees must be provided along with the application.

Documents Required: The documents required for obtaining an IEC may vary depending on the applicant type (individual, company, partnership firm, etc.). Generally, the documents include proof of identity, address proof, bank details, and business entity proof.

Validity and Renewal: Once issued, the IEC is valid for a lifetime and does not require renewal. However, if any changes or modifications are made to the details provided during the application process, the DGFT must be informed.

Use of IEC: The IEC must be quoted on all import and export documents, such as invoices, shipping bills, and customs declarations. It serves as a unique identifier for tracking import and export transactions.

Exemptions: In certain cases, specific individuals or entities may be exempted from obtaining the IEC. For example, importers or exporters who engage in certain specified categories of goods or services may be exempted from the requirement.