Home > TDS Compliances > TDS on sale & Purchase of Property

TDS on Sale & Purchase of Property

File your business tax returns and maintain compliance seamlessly through Accountingforte.

Basic

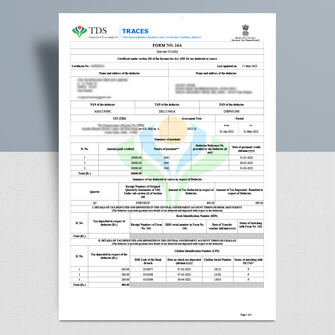

✅ TDS Challan Cum Return

✅ TDS Certificate

✅ TDS Acknowledgement

✅ TDS Calculations

Other Related Services

GST Registration, Invoicing, GST Filing, TDS Return Filing, Accounting, Income Tax Return (ITR) Filing, Banking and Payroll

GST Invoice

Get GST eInvoice with Input Tax Credit

Price Summary

Affordable Prices

Payment Per Return

TDS on sale & Purchase of Property

TDS (Tax Deducted at Source) is a system implemented in India that requires the payer to deduct tax at the source when making certain payments, including property transactions. When it comes to the purchase of property, TDS is applicable under Section 194-IA of the Income Tax Act, 1961.

Applicability: TDS on the purchase of property is applicable when the Purchase value exceeds Rs. 50 lakhs.

TDS Rate: The current TDS rate for property transactions is 1% of the transaction value.

TDS Deduction and Payment: The buyer is responsible for deducting TDS from the payment to the seller at the time of making the payment for the property. The deducted TDS amount should be deposited with the government within 30 days of payment.

Form 26QB: The buyer is required to file Form 26QB, which is the challan-cum-statement for TDS on property transactions. This form contains details of the property, buyer, seller, and transaction value.