Home > Registration > SSI – MSME Registration

Document Required:

PAN Card

Aadhar Card

Bank Account Details

Rent Agreement & Electricity Bill

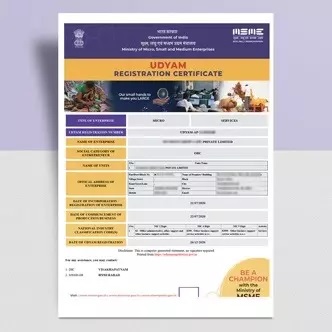

UDYAM Registration - MSME

MSME Registration is the process of registering a business with the Ministry of Micro, Small and Medium Enterprises (MSME) of India.

Basic

✅ UDYAM Registration – MSME

Other Related Services

GST Registration, Invoicing, GST Filing, TDS Return Filing, Accounting, Income Tax Return (ITR) Filing, Banking and Payroll

Free Current Bank Account

Zero Account Maintenance Charges for 1 Year

GST Invoice

Get GST eInvoice with Input Tax Credit

Price Summary

Market Price: ₹4,999

Accountingforte: ₹1,499 All Inclusive

You Save: ₹3,500 (70%)

Government Fee: Included

Accountingforte: ₹1,499 All Inclusive

You Save: ₹3,500 (70%)

Government Fee: Included

SSI – MSME Registration

MSME Registration is the process of registering a business with the Ministry of Micro, Small and Medium Enterprises (MSME) of India. MSME Registration is mandatory for businesses that meet the following criteria:

The business must be engaged in manufacturing or service activities.

The business must have an annual turnover of less than INR 250 crore.

The business must have a fixed asset investment of less than INR 50 crore.

MSME Registration offers a number of benefits to businesses, including:

Access to government schemes and subsidies.

Preference in government procurement.

Easier access to credit from banks and financial institutions.

Reduced compliance burden.

Documents Required for MSME registration depends on type of Entity

Aadhaar Card: The Aadhaar card of the proprietor, partner, or authorized signatory of the business is required for MSME registration. It serves as proof of identity and address.

Business Address Proof: Documents providing proof of the business address, such as a rent agreement, lease deed, or property ownership documents, need to be submitted.

Business Registration Certificate: Depending on the type of business entity, relevant registration certificates may be required. For example, a partnership firm may provide a partnership deed, a company can submit the Certificate of Incorporation, or a society can submit the society registration certificate.

PAN Card: The Permanent Account Number (PAN) card of the business entity or the proprietor/partner is required.

GST Registration Certificate: If the business is registered under the Goods and Services Tax (GST), a copy of the GST registration certificate needs to be submitted.

Bank Account Statement: A copy of the latest bank account statement, preferably for the last six months, showing the business transactions and operations, needs to be provided.