Home > Registration > Trust Registration

Document Required:

PAN Card

Aadhar Card

Passport Size Photograph

Electricity Bill

Telephone Bill

Property Tax Receipt

2 Wittness

Trust Registration

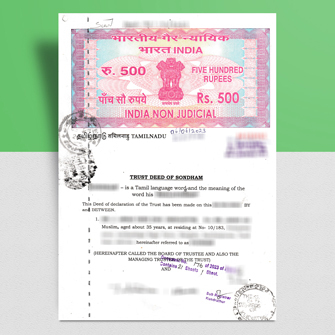

Trust Deed drafting along with Trust Registration.

Basic

Trust Deed Drafting

Trust Deed Drafting

Trust Registration Certificate

Trust Registration Certificate

PAN Card

PAN Card

Other Related Services

12AA & 80G Registration, TDS Return Filing, Donation Return Filing, Accounting, Income Tax Return (ITR) Filing, Banking and Payroll

Free Current Bank Account

Zero Account Maintenance Charges for 1 Year

GST Invoice

Get GST eInvoice with Input Tax Credit

Price Summary

Market Price: ₹19,999 – 24,999

Accountingforte: ₹14,999 All Inclusive

You Save: ₹5,000 – 10, 000

Government Fee: Included

Accountingforte: ₹14,999 All Inclusive

You Save: ₹5,000 – 10, 000

Government Fee: Included

Trust Registration

A trust is a legal arrangement in which one party, known as the settlor or grantor, transfers assets or property to another party, known as the trustee, for the benefit of a third party or parties, known as beneficiaries. The trust is created based on a trust agreement or a trust deed, which outlines the terms and conditions of the trust.

Here are the key components of a trust:

Settlor: The person who establishes the trust and transfers assets or property into it. The settlor determines the terms of the trust and may also be a beneficiary.

Trustee: The person or entity (such as a bank or a trust company) responsible for managing the trust and its assets. The trustee has a legal obligation to act in the best interests of the beneficiaries and administer the trust according to its terms.

Beneficiary: The individual(s) or entities who receive the benefits of the trust. They can be designated by name or identified by a particular class (e.g., children, grandchildren, charitable organizations).

Trust Property/Assets: The assets or property that are transferred into the trust by the settlor. This can include various types of assets, such as cash, real estate, investments, businesses, or personal belongings.

The specific documents required for trust registration can vary depending on the jurisdiction and the purpose of the trust. Documents required for registration of Trust:

Trust Deed: This is the core document that outlines the terms and conditions of the trust. It includes details such as the trust’s name, objectives, beneficiaries, trustees, and provisions for the management and distribution of assets.

Identity and Address Proof: Documents verifying the identity and residential address of the trustees and the settlor/grantor may be required. These can include passport copies, driver’s licenses, or utility bills.

Affidavit or Declaration by Trustees: Trustees may be required to provide an affidavit or declaration stating their willingness to act as trustees, their eligibility, and any relevant disclosures or declarations as per local laws.

List of Beneficiaries: A list of the beneficiaries, along with their details such as names, addresses, and their relationship to the settlor, may be required.

Consent Letters: If any individual or entity is named as a trustee or a beneficiary, their written consent to act as such may be required.

Witness Statements: In some cases, witness statements or affidavits from witnesses who were present during the execution of the trust deed may be necessary.

Registration Forms: Depending on the jurisdiction, specific registration forms may need to be completed and submitted to the appropriate government department or regulatory authority responsible for trust registration.