Home > Income Tax > Assessment of Income Tax

Assessment of Income Tax

Consultation for Income Tax Notice handling and response from a Tax Expert.

Basic

CIT Appeals

CIT Appeals

ITAT Appeals

ITAT Appeals

Regular IT Assessment

Regular IT Assessment

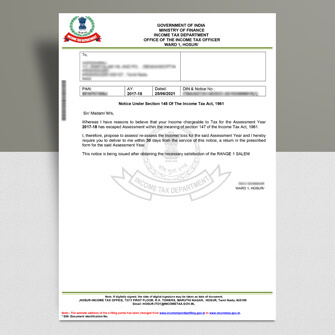

Reply of Notices 142(1), 147, 144, 143(2)

Reply of Notices 142(1), 147, 144, 143(2)

Other Related Services

GST Registration, Invoicing, GST Filing, TDS Return Filing, Accounting, Income Tax Return (ITR) Filing, Banking and Payroll

GST Invoice

Get GST eInvoice with Input Tax Credit