Home > Startup > Indian Subsidiary

Document Required:

Director KYC-

PAN Card

Aadhar Card

Voter ID Card/Passport/Driving License

Passport (Foreign National Only)

Latest 6 Months Bank Statements

Passport Size Photograph

Rent Agreement & Electricity Bill

Indian Subsidiary

Company Registration including Government Fee & Stamp Duty*. Incorporation kit with Share Certificates.

Basic

✅ Company Registration

✅ Share Certificates

✅ PAN Card

✅ TAN

✅ ESIC & EPF

✅ 3 Digital Signature (DSC)

✅ 1 Run Name Approval

✅ Current Account Opening

Other Related Services

GST Registration, Accounting, Invoicing, GST Filing, TDS Return Filing, Income Tax Return (ITR) Filing, ROC Filing, Banking and Payroll

Free Current Bank Account

Zero Account Maintenance Charges for 1 Year

GST Invoice

Get GST eInvoice with Input Tax Credit

Price Summary

Market Price: ₹44,999

Accountingforte: ₹29,249 All Inclusive

You Save: ₹15,750 (35%)

Government Fee: Included

Accountingforte: ₹29,249 All Inclusive

You Save: ₹15,750 (35%)

Government Fee: Included

Market Price: ₹15,000

Accountingforte:

₹7,499 All Inclusive

₹2457 + ₹442 GST

You Save: ₹7,501 (51%)

Government Fee: Included

Indian Subsidiary

An Indian subsidiary refers to a company that is incorporated and operates in India but is owned and controlled by a foreign company. It is a common structure for foreign businesses looking to establish a presence in the Indian market or engage in business activities in India.

Ownership: An Indian subsidiary is owned by a foreign company or a foreign individual. The foreign company, known as the parent company, holds a majority or complete ownership stake in the Indian subsidiary.

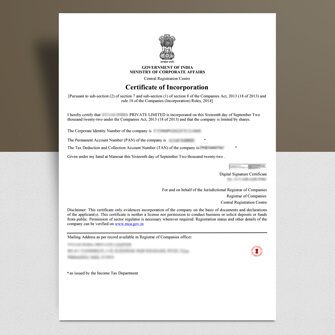

Legal Entity: The Indian subsidiary is a separate legal entity distinct from its parent company. It is incorporated under the laws and regulations of India, typically as a private limited company or a limited liability company (LLC).

Limited Liability: One of the advantages of an Indian subsidiary is that it offers limited liability protection to its shareholders. The liability of the shareholders is limited to the extent of their shareholding in the subsidiary, safeguarding their personal assets from the debts and liabilities of the subsidiary.

Compliance and Governance: An Indian subsidiary is subject to the legal and regulatory framework of India. It must comply with various legal requirements, including filing annual financial statements, conducting regular board meetings, and adhering to corporate governance norms prescribed by Indian laws.

Indian Directors: An Indian subsidiary is required to have at least two resident Indian directors on its board. These directors play a crucial role in the management and decision-making of the subsidiary. They ensure compliance with Indian laws and represent the interests of the subsidiary within India.

Operations and Business Activities: An Indian subsidiary can engage in various business activities, subject to sector-specific regulations and permissions required by Indian authorities. It can conduct operations such as manufacturing, trading, services, or research and development, depending on the objectives and scope of the subsidiary.

Taxation: An Indian subsidiary is subject to Indian taxation laws. It is liable to pay taxes on its income generated within India. Tax rates and regulations may vary depending on the nature of the business and the applicable tax laws.