Home > Business Registration > NBFC Company

Document Required:

Director KYC-

PAN Card

Aadhar Card

Voter ID Card/Passport/Driving License

Latest 6 Months Bank Statements

Passport Size Photograph

Rent Agreement & Electricity Bill

NBFC Company

Company Registration including Government Fee & Stamp Duty*. Incorporation kit with Share Certificates.

Basic

NBFC Company Registration

NBFC Company Registration

Share Certificates

Share Certificates

RBI Registration Certificate

RBI Registration Certificate

PAN Card

PAN Card

TAN

TAN

ESIC & EPF

ESIC & EPF

2 Digital Signature (DSC)

2 Digital Signature (DSC)

1 Run Name Approval

1 Run Name Approval

Current Account Opening

Current Account Opening

Offers and discounts

Refer a Friend

Other Related Services

GST Registration, Accounting, Invoicing, GST Filing, TDS Return Filing, Income Tax Return (ITR) Filing, ROC Filing, Banking and Payroll

Free Current Bank Account

Zero Account Maintenance Charges for 1 Year

GST Invoice

Get GST eInvoice with Input Tax Credit

Price Summary

Affordable Prices

NBFC Company

An NBFC (Non-Banking Financial Company) is a financial institution that provides banking/Loan services without meeting the legal definition of a bank. The specific requirements and documents needed for incorporating an NBFC are KYC of Directors, Address Proof, MOA & AOA. After incorporation of NBFC with MCA we need to take RBI approval for NBFC to run Banking/Loan Services.

Here are some of the commonly required documents for NBFC incorporation in India

An NBFC (Non-Banking Financial Company) is a financial institution that provides banking/Loan services without meeting the legal definition of a bank. The specific requirements and documents needed for incorporating an NBFC are KYC of Directors, Address Proof, MOA & AOA. After incorporation of NBFC with MCA we need to take RBI approval for NBFC to run Banking/Loan Services.

Here are some of the commonly required documents for NBFC incorporation in India.

Name of NBFC: First we need to fix a Name for NBFC.

Memorandum of Association (MOA) and Articles of Association (AOA): These documents outline the objectives and rules for the NBFC’s operations. The MOA and AOA need to be prepared and submitted according to the Companies Act, 2013.

Directors’ documents: The following documents related to the proposed directors of the NBFC are generally required:

Identity proof (such as PAN card, passport, Aadhaar card, etc.)

Address proof (such as passport, utility bill, bank statement, etc.)

Photographs

Educational qualifications and experience certificates

Shareholders’ documents: Documents related to the shareholders of the NBFC may include:

Identity proof

Address proof

Photographs

Director’s Declaration: A declaration stating that the proposed director(s) of the NBFC do not have any criminal record and have not been declared insolvent.

Capital adequacy requirements: NBFCs need to meet minimum capital requirements of 2 crore.

Fit and Proper Criteria: Directors and shareholders of the NBFC need to meet the fit and proper criteria set by the regulatory authority. This may involve providing declarations, affidavits, and background checks.

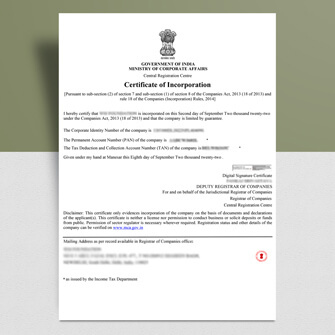

(RoC) after the company is registered. It serves as proof of the NBFC’s legal existence.

Certificate of Incorporation: This document is issued by the Registrar of Companies