Home > Registration > GST Registration

Document Required:

PAN Card

Aadhar Card

Electricity Bill

Telephone Bill

Property Tax Receipt

GST Registration

End-to-End Assistance* for GST registration and ensure to have harmonious process for Invoicing, E-invoicing and filing through software.

Basic

GST Registration

GST Registration

GST Invoicing

GST Invoicing

GST E-Invoicing

GST E-Invoicing

Other Related Services

Invoicing, GST Filing, TDS Return Filing, Accounting, Income Tax Return (ITR) Filing, Banking and Payroll

Free Current Bank Account

Zero Account Maintenance Charges for 1 Year

GST Invoice

Get GST eInvoice with Input Tax Credit

Price Summary

Market Price: ₹5,999

Accountingforte: ₹2499 All Inclusive

You Save: ₹3,500 (58%)

Government Fee: Included

Accountingforte: ₹2499 All Inclusive

You Save: ₹3,500 (58%)

Government Fee: Included

Offers and discounts

GST Registration

GST registration refers to the process of obtaining a Goods and Services Tax (GST) identification number for a business or entity. GST is a value-added tax levied on the supply of goods and services in many countries worldwide. The specific requirements and procedures for GST registration can vary depending on the jurisdiction.

GST registration threshold depends on the type of business and the state in which it operates. The threshold for most businesses is an annual turnover of Rs 40 Lakh in case of Goods or 20 Lakh in case of supply of services. (Turnover Limit is different for businesses in some special category states). However, there are separate thresholds for certain categories of businesses, such as businesses engaged in the supply of goods in certain northeastern states or businesses engaged in the supply of services.

Determine eligibility: Before registering for GST, you should determine if your business meets the eligibility criteria for registration. This typically includes factors such as the annual turnover of the business, the nature of the goods or services provided, and the jurisdiction’s specific thresholds for GST registration.

Gather required information and documents: To register for GST, you will need to provide certain information and documentation. This usually includes details such as the business’s legal name, address, contact information, nature of business activities, and the names and identification details of the business owners or directors. Additionally, you may need to submit supporting documents such as business registration certificates, identity proofs, and proof of address.

Complete the GST registration application: Depending on the jurisdiction, the GST registration application may be submitted online or through a physical form. The application form will require you to provide the necessary information and attach any required documents. Ensure that all the details provided are accurate and up to date.

Submit the application and pay fees: Once the application is complete, submit it to the designated tax authority along with any applicable fees. The fees can vary depending on the jurisdiction and the nature of the business.

Verification and processing: After receiving the application, the tax authority will verify the information provided and conduct any necessary checks. This may involve verifying the business details, conducting background checks, and ensuring compliance with the eligibility criteria.

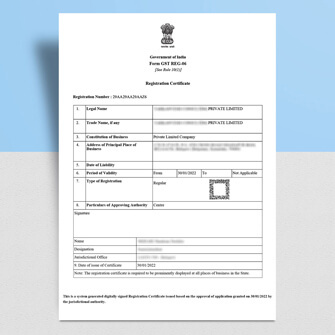

GST registration certificate: If the application is approved, the tax authority will issue a GST registration certificate or a unique GST identification number (GSTIN) for your business. This certificate or GSTIN serves as proof of your business’s registration for GST purposes.

Compliance and ongoing obligations: Once registered for GST, you are required to comply with the ongoing obligations imposed by the jurisdiction. This includes filing regular GST returns, maintaining proper records of transactions, collecting and remitting GST to the tax authorities, and adhering to any specific rules and regulations related to GST. Familiarize yourself with the specific compliance requirements and deadlines in your jurisdiction to ensure compliance.