Home > TDS Compliances > Consultancy related to TDS rate and TDS section

Consultancy related to TDS Rate & TDS Section

File your business tax returns and maintain compliance seamlessly through accountingforte. Get a Dedicated Accountant for your business.

Tax & HR Assist Accountant

TDS Return

TDS Return

TDS Computation

TDS Computation

Other Related Services

GST Registration, Invoicing, GST Filing, TDS Return Filing, Accounting, Income Tax Return (ITR) Filing, Banking and Payroll.

GST Invoice

Get GST eInvoice with Input Tax Credit

Price Summary

Affordable Prices

Payment per Filing

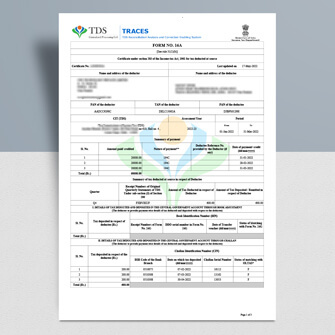

Consultancy related to TDS rate and TDS section

TDS (Tax Deducted at Source) rates and sections are important aspects of tax compliance in many countries, including India. TDS is a mechanism for collecting tax at the source of income generation. If you need consultancy related to TDS rates and TDS sections, here are some key points to consider:

Understanding TDS Rates: TDS rates vary based on the nature of payments and the provisions of the Income Tax Act. Different sections of the Act prescribe different TDS rates for various types of payments. For example, TDS rates for salary, interest, rent, professional fees, etc., may be different. It’s crucial to be aware of the applicable rates to ensure correct deduction and deposit of TDS.

Familiarity with TDS Sections: The Income Tax Act contains specific sections that govern different types of payments and their corresponding TDS provisions. For example, Section 192 deals with TDS on salary, Section 194A relates to TDS on interest, Section 194C covers TDS on contractors and sub-contractors, and so on. Understanding the relevant sections is essential to comply with TDS requirements.

Compliance with TDS Deduction and Payment: TDS needs to be deducted from the payment made to the recipient and deposited with the government within the specified timelines. Consulting with experts can help you understand the procedural aspects of TDS deduction, filing TDS returns, and remitting the TDS amount to the government.

Updates on Changes and Amendments: TDS rates and sections may be subject to changes through budget announcements, amendments to tax laws, or circulars issued by tax authorities. Staying updated on such changes is crucial to ensure accurate compliance. Consulting with professionals who specialize in tax matters can help you stay abreast of any changes in TDS rates and sections.

Expert Advice and Documentation: Engaging a consultancy firm or tax expert with experience in TDS can provide you with expert advice tailored to your specific needs. They can assist you in understanding the applicability of TDS, help you calculate the TDS amount correctly, guide you on the required documentation, and provide support in TDS-related audits or assessments.