Home > Startup > Section 8 Company

Document Required:

Director KYC-

PAN Card

Aadhar Card

Voter ID Card/Passport/Driving License

Latest 6 Months Bank Statements

Passport Size Photograph

Rent Agreement & Electricity Bill

Section 8 Company

Incorporation of Section 8 Company including Government Fee & Stamp Duty*. Incorporation kit with Share Certificates.

Basic

Company Registration

Company Registration

Section 8 License

Section 8 License

Share Certificates

Share Certificates

PAN Card

PAN Card

TAN

TAN

ESIC & EPF

ESIC & EPF

2 Digital Signature (DSC)

2 Digital Signature (DSC)

1 Run Name Approval

1 Run Name Approval

Current Account Opening

Current Account Opening

Other Related Services

GST Registration, Accounting, Invoicing, GST Filing, TDS Return Filing, Income Tax Return (ITR) Filing, ROC Filing, Banking and Payroll

Free Current Bank Account

Zero Account Maintenance Charges for 1 Year

GST Invoice

Get GST eInvoice with Input Tax Credit

Price Summary

Market Price: ₹24,999

Accountingforte: ₹14,160 All Inclusive

You Save: ₹10,839 (43%)

Government Fee: Included

Accountingforte: ₹14,160 All Inclusive

You Save: ₹10,839 (43%)

Government Fee: Included

Market Price: ₹25,000

Accountingforte: ₹14,499 All Inclusive

You Save: ₹10,840 (51%) Government Fee: Included

Accountingforte: ₹14,499 All Inclusive

You Save: ₹10,840 (51%) Government Fee: Included

Section 8 Company

A Section 8 company, also known as a Section 8 not-for-profit company, is a type of legal entity established under Section 8 of the Companies Act, 2013 in India. It is formed for promoting charitable or not-for-profit objectives such as social welfare, education, art, science, research, religion, or any other similar purpose.

Non-Profit Nature: A Section 8 company is formed with the primary objective of promoting charitable or not-for-profit activities. Its profits, if any, are utilized for the promotion of its objectives and are not distributed among its members

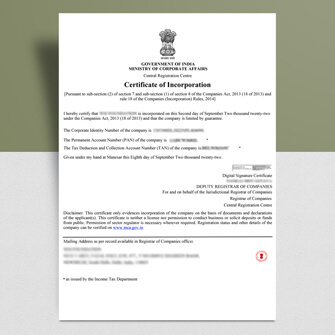

Registration and Approval: To establish a Section 8 company, an application must be made to the Registrar of Companies (ROC). The application must include the memorandum and articles of association, along with the necessary supporting documents and declarations. Approval from the ROC is required for the incorporation of a Section 8 company.

Name Restrictions: The name of a Section 8 company must end with the words “Foundation,” “Association,” “Society,” “Council,” “Club,” “Organization,” or other similar terms prescribed by the government. The name should not resemble or be identical to an existing company or trademark.

Statutory Compliance: Section 8 companies must comply with various legal obligations, including filing annual financial statements, holding annual general meetings, and maintaining proper accounting records. They are subject to audit requirements based on their turnover and funding sources.