Home > Income Tax > Income Tax return of Private Limited & Public Limited

Income Tax Return of Private Limited & Public Limited

Income tax return filing for Companies whose annual turnover is upto Rs.10 lakhs.

Basic

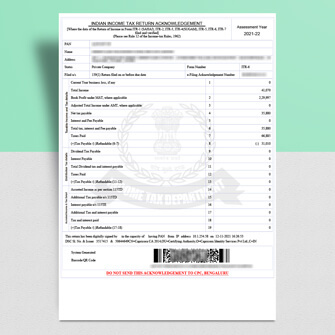

✅ ITR Acknowledgement

✅ ITR Form

✅ ITR Computation

Other Related Services

Preparation of Financial Statement, ROC Filing, GST Registration, Invoicing, GST Filing, TDS Return Filing, Accounting, Income Tax Return (ITR) Filing, Banking and Payroll

GST Invoice

Get GST eInvoice with Input Tax Credit

Price Summary

Market Price: ₹7,999

Accountingforte: ₹3999 All Inclusive

You Save: ₹4,000 (50%)

Government Fee: Included

Accountingforte: ₹3999 All Inclusive

You Save: ₹4,000 (50%)

Government Fee: Included