Computation of income tax return involves determining the taxable income, applying the applicable tax rates, and calculating the tax liability. Here is a general overview of the steps involved in computing an income tax return:

Determine Gross Income: Start by calculating your gross income, which includes income from all sources, such as salary, business profits, rental income, interest, dividends, and capital gains.

Deduct Exemptions and Deductions: Identify and subtract any exemptions or deductions allowed by the tax laws. These may include exemptions for certain types of income, deductions for expenses like medical bills, home loan interest, insurance premiums, and contributions to retirement plans.

Calculate Total Taxable Income: Subtract the exemptions and deductions from your gross income to arrive at your total taxable income.

Determine Applicable Tax Rates: Refer to the income tax slab rates or tax brackets applicable in your country or jurisdiction. The tax rates typically increase with higher income levels.

Apply Tax Rates: Apply the relevant tax rates to the respective income brackets to calculate the tax liability for each bracket.

Account for Tax Credits: Consider any tax credits available, which can directly reduce your tax liability. Tax credits are typically provided for specific purposes like education, energy efficiency, or foreign tax credits.

Calculate Tax Liability: Sum up the tax liabilities for each income bracket and subtract any applicable tax credits. The resulting amount is your total tax liability.

Account for Prepaid Taxes and Withholdings: Deduct any taxes already paid through withholding from your salary, estimated tax payments, or other prepaid taxes. This will determine if you owe any additional taxes or are eligible for a refund.

File the Income Tax Return: Complete the appropriate income tax return form provided by the tax authorities. Enter the calculated tax liability, along with other required information and supporting documents. Ensure accuracy and compliance with the specific rules and regulations of your country or jurisdiction.

It’s important to note that the exact computation and specific tax laws can vary significantly depending on the country or jurisdiction.

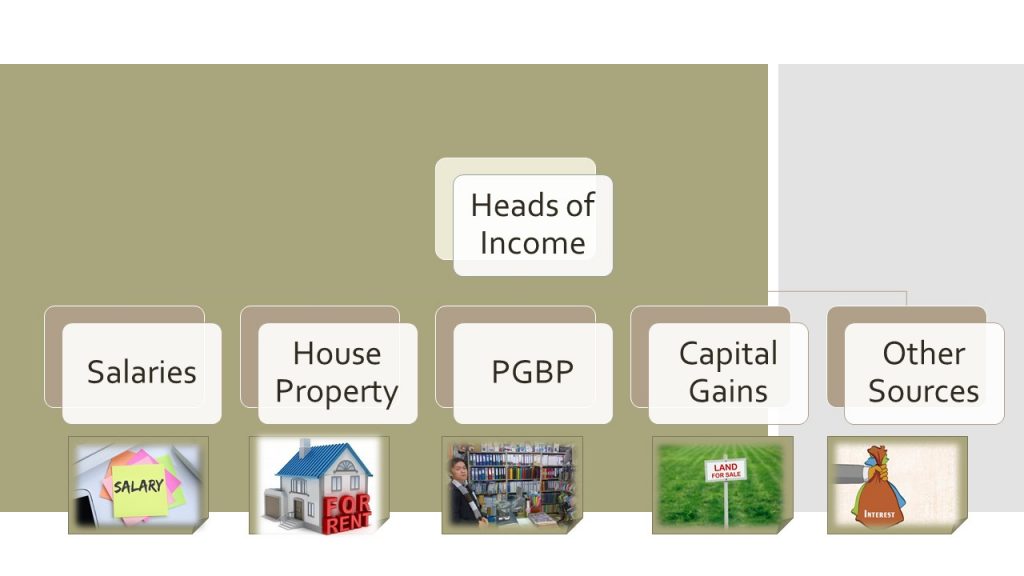

In the context of income tax, “Heads of Income” refer to different categories or sources of income that are recognized by tax authorities for the purpose of taxation. The specific heads of income can vary from one country to another. However, in many countries, including India, the following are commonly recognized as the five heads of income:

Income from Salary: This head includes income earned by an individual as an employee or through employment contracts. It covers salary, wages, bonuses, allowances, commissions, and other similar forms of remuneration received from employment.

Income from House Property: This head includes income earned from owning and renting out a house, building, or land. Rental income, whether from residential or commercial properties, is considered under this head. Additionally, notional rent may be calculated for self-occupied properties as per local tax laws.

Profits and Gains from Business or Profession: This head encompasses income generated from carrying out a business, trade, profession, or vocation. It includes income from self-employment, business profits, professional fees, consulting income, and any other income arising from entrepreneurial activities.

Capital Gains: This head involves income generated from the sale or transfer of capital assets, such as real estate, stocks, bonds, mutual funds, and other investments. Capital gains can be classified as short-term or long-term, depending on the holding period of the asset.

Income from Other Sources: This head includes income that does not fall under any of the above categories. It encompasses various types of income, such as interest income, dividends, rental income from machinery or equipment, lottery or gambling winnings, royalties, and any other income not covered by the previous heads.

It’s important to note that the classification and specific heads of income can vary between countries. The tax laws and provisions in your jurisdiction will determine the heads of income relevant to you.