Home > Accounting > Cost Account Maintenance

Cost Account Maintenance

End-to-End Assistance* for Cost Account Maintenance and ensure to have harmonious process for Costing through software.

Basic

✅ Cost Management

✅ Cost Minimization

✅ Preparation of Cost Sheet

✅ Consultancy Related to Cost Control

✅ Fixing Price of Each Item

Other Related Services

Preparation of Financials, Annual Accounts, Maintenance of Monthly Books, GST Registration, Invoicing, GST Filing, Income Tax Return (ITR) Filing, Banking and Payroll

Free Current Bank Account

Zero Account Maintenance Charges for 1 Year

GST Invoice

Get GST eInvoice with Input Tax Credit

Price Summary

Cost Account Maintenance

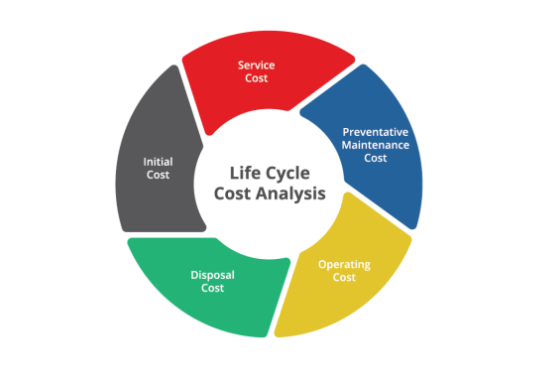

Cost account maintenance refers to the process of recording, tracking, and managing costs within an organization. It involves the systematic recording and analysis of cost-related information to support decision-making, cost control, and financial management.

Cost Classification: Establishing a structured framework for classifying costs based on their nature, behavior, and purpose. Common cost classifications include direct costs, indirect costs, variable costs, fixed costs, product costs, period costs, and relevant costs for decision-making.

Cost Recording: Recording costs in the accounting system or cost ledger. This involves capturing costs associated with raw materials, labor, overheads, and other cost elements. Costs can be recorded using various methods, such as job costing, process costing, or activity-based costing (ABC).

Cost Analysis: Analyzing costs to understand their behavior, variability, and trends. This includes calculating cost per unit, cost variances, cost-volume-profit analysis, and identifying cost drivers that impact expenses.

Inventory Valuation: Maintaining accurate inventory records and valuing inventory using appropriate costing methods, such as first-in, first-out (FIFO) or weighted average cost. This ensures the proper allocation of costs to products and helps determine the cost of goods sold (COGS) for financial reporting purposes.

Cost Control: Monitoring and controlling costs to ensure they align with budgeted targets. This involves comparing actual costs with budgeted costs, investigating variances, and implementing corrective actions to address cost overruns or inefficiencies.

Cost Reporting: Generating cost reports to provide management with relevant cost information. Cost reports may include cost statements, variance reports, cost performance metrics, and profitability analysis by product, customer, or project.

Cost Estimation: Estimating costs for new products, projects, or activities using cost estimation techniques such as historical data analysis, benchmarking, or expert judgment. Accurate cost estimation helps in pricing decisions and evaluating the feasibility of business initiatives.

Cost Planning: Developing cost budgets and forecasts based on projected activities, sales volumes, and cost drivers. Cost planning involves setting targets, identifying cost reduction opportunities, and aligning costs with business objectives.

Continuous Improvement: Regularly reviewing and improving cost accounting processes and systems to enhance accuracy, efficiency, and relevance. This may involve implementing cost accounting software, conducting cost audits, and leveraging technology for cost data capture and analysis.