Home > Registration > CSR Donation Registration

Document Required:

PAN Card

Certificate of Incorporation (COI)

Memorandum of Association (MOA)

Articles of Association (AOA)

Annual Financial Statements

Board Resolution

CSR Policy

CSR Committee Report

CSR Donation Registration

End-to-End Assistance* for CSR Registration and ensure to have harmonious process for CSR Donation.

Basic

✅ CSR Registration

✅ Free Expert Guidance

Other Related Services

GST Registration, Invoicing, GST Filing, TDS Return Filing, Accounting, Income Tax Return (ITR) Filing, Banking and Payroll

Free Current Bank Account

Zero Account Maintenance Charges for 1 Year

GST Invoice

Get GST eInvoice with Input Tax Credit

Price Summary

Market Price: ₹5,999

Accountingforte: ₹2999 All Inclusive

You Save: ₹3,000 (50%)

Government Fee: Included

Accountingforte: ₹2999 All Inclusive

You Save: ₹3,000 (50%)

Government Fee: Included

CSR Donation Registration

CSR (Corporate Social Responsibility) Donation Registration refers to the process of registering and documenting donations made by a company towards its CSR initiatives. Corporate Social Responsibility is a concept that encourages businesses to contribute positively to society by engaging in activities that benefit the community, the environment, and other stakeholders.

In many countries, including India, companies are required by law to allocate a certain percentage of their profits towards CSR activities. These activities can include initiatives related to education, healthcare, environmental sustainability, poverty alleviation, skill development, and more.

When a company makes donations towards its CSR initiatives, it is often necessary to register these donations with the appropriate authorities. This registration helps ensure transparency, accountability, and proper utilization of the donated funds.

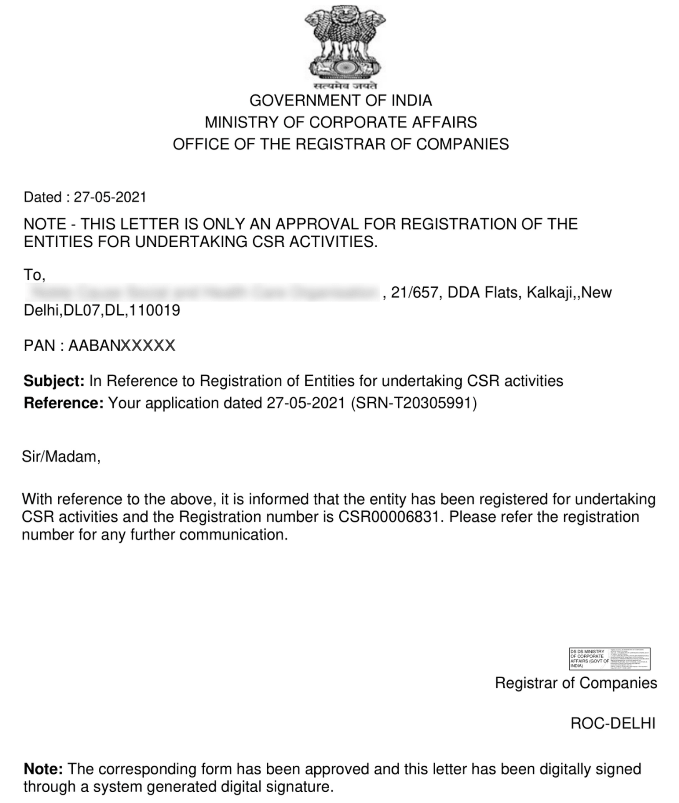

The specific process and requirements for CSR donation registration can vary depending on the jurisdiction and applicable laws. In India, for example, companies are required to register their CSR donations with the Ministry of Corporate Affairs (MCA) through an online portal called the “CSR Reporting Portal.”

Companies typically need to provide details of the donations made, including the amount, purpose, recipient organization, and any other relevant information. They may also need to submit supporting documents such as bank statements, receipts, and agreements with recipient organizations.

CSR donation registration helps track and monitor the CSR activities of companies, ensures compliance with legal requirements, and promotes transparency in the utilization of CSR funds. It also enables stakeholders, including government authorities, shareholders, and the public, to access information about the company’s CSR initiatives and their impact on society.

It’s important for companies to familiarize themselves with the specific regulations and requirements related to CSR donation registration in their jurisdiction to ensure compliance with the applicable laws and guidelines.

The documents required for CSR (Corporate Social Responsibility) registration can vary depending on the country and the specific regulations in place. However, here are some common documents that may be required for CSR registration:

Memorandum of Association (MOA) and Articles of Association (AOA): These are legal documents that outline the company’s objectives, structure, and rules of operation. They may be required to verify the company’s existence and its authorized activities.

Certificate of Incorporation: This document proves the legal existence of the company and provides information such as the company’s name, registration number, and date of incorporation.

Annual Financial Statements: Companies may be required to submit their audited financial statements, including the balance sheet, profit and loss statement, and cash flow statement, for the preceding years. These statements help assess the financial health and capacity of the company to fulfill CSR obligations.

Board Resolution: A board resolution is a formal document that demonstrates the approval and authorization of CSR activities by the company’s board of directors. It may include details such as the allocation of funds for CSR, selection of specific projects, and approval of policies related to CSR.

CSR Policy: Many jurisdictions require companies to have a CSR policy outlining their objectives, approach, and implementation strategies for CSR initiatives. The policy should define the focus areas, target beneficiaries, and the expected social impact of the CSR activities.

CSR Committee Report: In some cases, companies are required to submit a report on the CSR activities conducted during the financial year. This report provides an overview of the projects undertaken, funds allocated and spent, and the impact achieved.