Home > Income Tax > Filling of others Forms of Income Tax

Filling of Others Forms of Income Tax

Basic

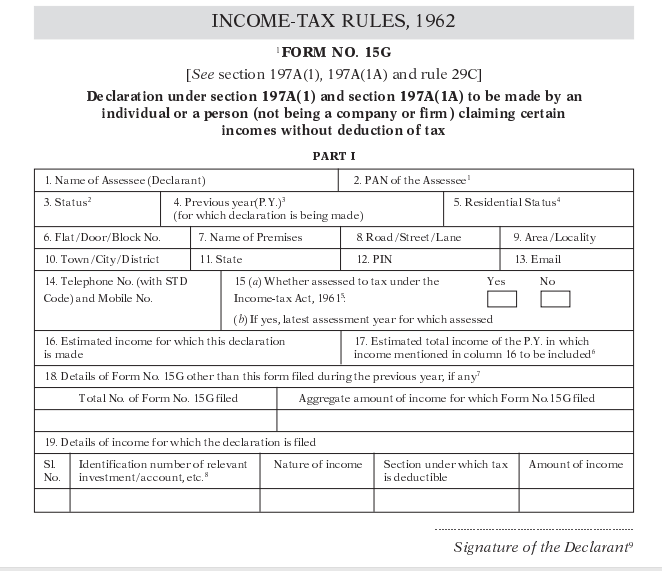

✅ Form 15G/15H

✅ Form 15CA & 15CB

✅ Form 10E

✅ 80G

✅ Schedule D, DI

Other Related Services

12AA & 80G Registration, GST Registration, Invoicing, GST Filing, TDS Return Filing, Accounting, Income Tax Return (ITR) Filing, Banking and Payroll

GST Invoice

Get GST eInvoice with Input Tax Credit

Price Summary

Market Price: Depend upon Forms

Accountingforte: Depend upon Forms

Government Fee: Depend upon Forms

Accountingforte: Depend upon Forms

Government Fee: Depend upon Forms