Home > Startup > Foreign Company Incorporation

Document Required:

Director KYC-

Passport

Certificate of Incorporation – Home Country

Memorandum and Articles of Association

Financial Statements

Tax Identification Number

Rent/Lease Agreement & Electricity Bill

Company Profile

Foreign Company Incorporation

Includes LLC or C-Corporation Incorporation along with 1 Year Registered Agent. (FastTrack Company Incorporation with EIN number)

Country in which we Incorporate Companies-

USA, UK, UAE, Australia, Canada

Other Related Services

Tax Registration, Accounting, Invoicing, Tax Return Filing

GST Invoice

Get GST eInvoice with Input Tax Credit

Price Summary

Market Price: Vary Country to Country

Accountingforte: Vary Country to Country

You Save: Vary Country to Country

Government Fee: Included

Accountingforte: Vary Country to Country

You Save: Vary Country to Country

Government Fee: Included

Foreign Company Incorporation

Incorporating a foreign company refers to the process of establishing and registering a company in a country other than its home country. This allows the company to operate and conduct business activities in the foreign country while complying with local laws and regulations. The specific requirements and procedures for incorporating a foreign company vary by jurisdiction.

Research and Planning: Conduct thorough research on the target country’s business environment, legal requirements, market conditions, and industry-specific regulations. Determine if there are any restrictions or special permissions for foreign companies in that country.

Business Structure and Name: Decide on the appropriate legal structure for your foreign company, such as a subsidiary, branch office, or representative office. Choose a unique and compliant name for the company that adheres to the naming regulations of the target country.

Appoint Local Agents or Representatives: In many jurisdictions, foreign companies are required to appoint local agents, representatives, or directors who are residents of the target country. These individuals will act as a liaison and ensure compliance with local laws.

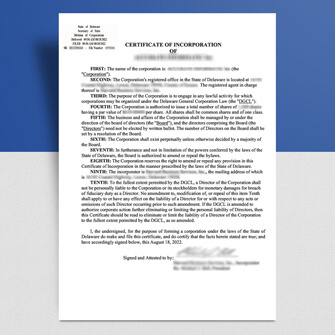

Legal and Registration Procedures: Understand the legal and registration procedures in the target country. This typically involves preparing and submitting various documents, such as the company’s articles of incorporation, memorandum of association, and other required forms, to the relevant government authorities. These documents may need to be translated into the local language and notarized.

Capital Requirements: Determine the minimum capital requirements, if any, for incorporating a foreign company in the target country. Make the necessary arrangements to fulfill these capital requirements, such as opening a local bank account and transferring the required funds.

Obtain Necessary Permits and Licenses: Identify any industry-specific permits, licenses, or registrations that your foreign company needs to operate legally in the target country. These may include business licenses, trade permits, or sector-specific certifications.

Taxation and Compliance: Understand the tax obligations and compliance requirements in the target country. Determine if there are any tax treaties or agreements between your home country and the target country that may impact your tax liabilities. Register for tax purposes and obtain a tax identification number, if required.

Post-Incorporation Compliance: Once the foreign company is incorporated, ensure ongoing compliance with local laws and regulations. This may include filing annual financial statements, conducting regular board meetings, maintaining proper accounting records, and adhering to other corporate governance requirements.