Home > Income Tax > Income Tax Return of Individual, HUF & Partnership

Document Required:

Salary Slip or Form 16

All Accounts Bank Statement

Loan Statement (if any)

P & L Statement of DEMAT Account (If any)

Donation Slip (if any)

GST Details of Your Firm (if any)

Sales, Purchase and Expenses Details

Any Other Income Details

Income Tax Return of Individual, HUF & Partnership

Income tax return filing for an individual and Partnership with income up to Rs.5 lakhs.

Basic

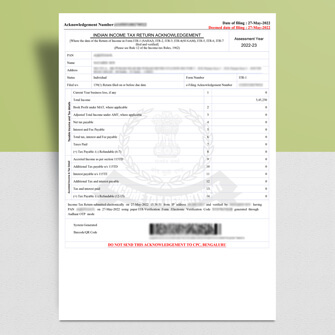

ITR Acknowledgement

ITR Acknowledgement

ITR Form

ITR Form

ITR Computation

ITR Computation

Balance Sheet (If Applicable)

Balance Sheet (If Applicable)

Other Related Services

GST Registration, Invoicing, GST Filing, TDS Return Filing, Accounting, Income Tax Return (ITR) Filing, Banking and Payroll

Price Summary

Market Price: ₹3999

Accountingforte: ₹999 All Inclusive

You Save: ₹3,000 (25%)

Government Fee: Included

Accountingforte: ₹999 All Inclusive

You Save: ₹3,000 (25%)

Government Fee: Included