Home > Finance Advisory > Projected & Proposed Financials

Projected & Proposed Financials

Projected Financial Statement alongeith the Project Report.

Basic

✅ Projected Financial Statement

✅ Proposed Financial Statement

✅ Project Report

✅ CMA Data

Other Related Service

Preparation of Financials, Annual Accounts, Maintenance of Monthly Books, GST Registration, Invoicing, GST Filing, Income Tax Return (ITR) Filing, Banking and Payroll

Free Current Bank Account

Zero Account Maintenance Charges for 1 Year

GST Invoice

Get GST eInvoice with Input Tax Credit

Price Summary

Projected & Proposed Financials

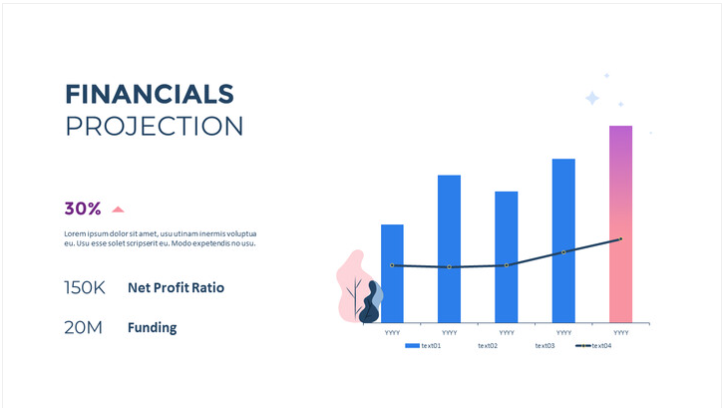

Projected and proposed financials are financial statements that provide estimates and forecasts of a company’s future financial performance and position. These statements are used for planning, budgeting, and decision-making purposes.

Projected Financials:

Projected financials are forward-looking statements that estimate the financial results and position of a company for a future period. They are based on assumptions, projections, and expectations regarding future revenues, expenses, investments, and other financial factors. Projected financials help businesses assess their future performance and make informed decisions about investments, expansion plans, financing options, and resource allocation.

Typically, projected financials include:

Projected Income Statement: Estimates of revenue, expenses, and profitability.

Projected Balance Sheet: Estimates of assets, liabilities, and equity at a specific point in the future.

Projected Cash Flow Statement: Estimates of cash inflows and outflows, highlighting the timing and availability of cash.

Proposed Financials: