Home > TDS Compliances > TDS Deposit

TDS Deposit

File your business tax returns and maintain compliance seamlessly through Accountingforte. Get a Dedicated Accountant for your business.

Basic

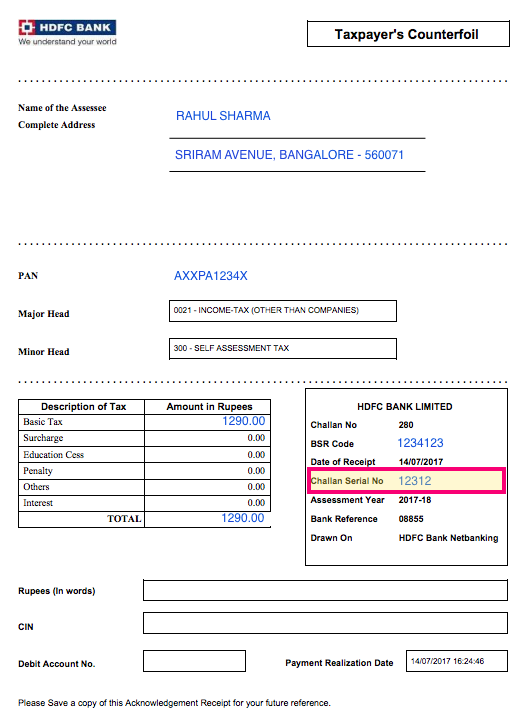

✅ TDS Challans

✅ TDS Calculations

Other Related Services

GST Registration, Invoicing, GST Filing, Accounting, Income Tax Return (ITR) Filing, Banking and Payroll

GST Invoice

Get GST eInvoice with Input Tax Credit

Price Summary

Affordable Prices

Payment Per Filing

TDS Deposit

The deposit date for TDS (Tax Deducted at Source) depends on the type of payment and the nature of the deductor. Here are some key points regarding TDS deposit and the corresponding due dates:

TDS Deposit for Non-Government Deductors:

For TDS deducted during the month of March: The due date for depositing TDS is April 30th of the same year.

For TDS deducted in months other than March: The due date for depositing TDS is the 7th of the following month. For example, TDS deducted in the month of July should be deposited by August 7th.

TDS Deposit for Government Deductors:

For TDS deducted during the month of March: The due date for depositing TDS is April 30th of the same year.

For TDS deducted in months other than March: The due date for depositing TDS is within two months from the end of the month in which the deduction is made. For example, TDS deducted in the month of July should be deposited by September 30th.