Home > TDS Compliances > TDS on Foreign Payment

TDS on Foreign Payment

File your business tax returns and maintain compliance seamlessly through Accountingforte. Get a Dedicated Accountant for your business.

Basic

✅ Consulatncy for TDS on Foreign Payment

✅ At what Rate TDS is Deducted

✅ Under Which Section TDS is Deducted

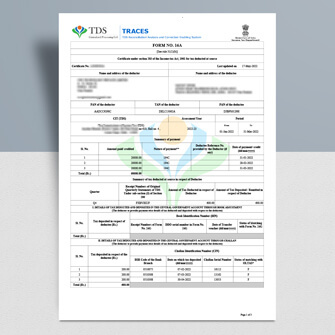

✅ TDS Certificate

Other Related Services

GST Registration, Invoicing, GST Filing, TDS Return Filing, Accounting, Income Tax Return (ITR) Filing, Banking and Payroll

GST Invoice

Get GST eInvoice with Input Tax Credit

Price Summary

Affordable Prices

Payment Per Return

TDS on Foreign Payment

Section 195 of the Income Tax Act, 1961 deals with the deduction of Tax Deducted at Source (TDS) on foreign payments made by residents in India.

Applicability: TDS under Section 195 is applicable when a resident in India makes a payment to a non-resident or a foreign company, which is taxable in India.

TDS Rate: The TDS rate for foreign payments can vary depending on the nature of the payment and the relevant tax treaty, if any, between India and the country of the non-resident. The rates are specified in the Income Tax Act or the applicable tax treaty. It is essential to refer to the specific provisions and rates for accurate information

Prepare the TDS Return: The TDS return for Section 195 deductions is filed in Form 27Q. The form captures details such as the TAN of the deductor, PAN of the deductee (non-resident), transaction details, TDS deduction details, and other relevant information. Ensure that all the details are accurately filled in the form.