Home > TDS Compliances > TDS Return like: 24Q, 26Q, 27Q, 27EQ

TDS Return Like: 24Q, 26Q, 27Q, 27EQ

File your business tax returns and maintain compliance seamlessly through Accountingforte. Get a Dedicated Accountant.

Tax & HR Assist Accountant

TDS Return Acknowledgement

TDS Return Acknowledgement

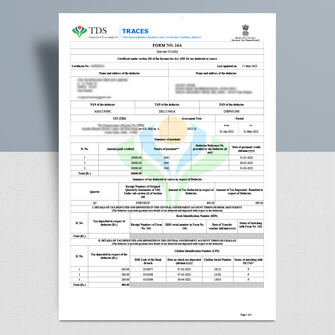

Form 16 & 16A

Form 16 & 16A

TDS Calculation

TDS Calculation

Other Related Services

GST Registration, Invoicing, GST Filing, TDS Return Filing, Accounting, Income Tax Return (ITR) Filing, Banking and Payroll

GST Invoice

Get GST eInvoice with Input Tax Credit

Price Summary

Affordable Prices

Payment Per Return

TDS Return like: 24Q, 26Q, 27Q, 27EQ

TDS (Tax Deducted at Source) return is a filing requirement in India for entities that deduct taxes at source from payments made to contractors, professionals, employees, commission agent, other parties. TDS is a mechanism used by the government to collect taxes at the time of payment itself. Applicability: Any entity that is liable to deduct TDS as per the provisions of the Income Tax Act, 1961 is required to file TDS returns. This includes companies, government departments, individuals (if audit u/s 44AB) , and other entities that make specified payments subject to TDS.

Types of TDS Returns: There are different TDS return forms depending on the nature of the deductee and type of payment. The most commonly used forms are:

Form 24Q: It is filed for TDS deducted on salary payments.

Form 26Q: It is filed for TDS deducted on payments other than salary.

Form 27Q: It is filed for TDS deducted on payments made to non-resident individuals, foreign companies, or foreign entities.

Form 27EQ: Form 27EQ is a quarterly statement that mention details and information regarding tax collected at source (TCS) at the end of every quarter as per Section 206C of the Income Tax Act 1961.